The Coming Succession Problem

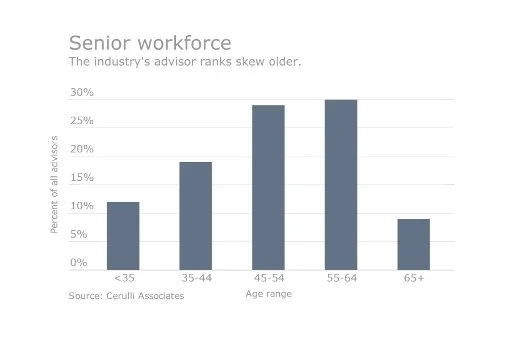

We’ve all heard the stat. The average age of financial advisors is hovering somewhere around 57 years old. The chart of advisor talent trends heavily to the right side of the graph.

In my line of work, I can’t help but think about what this means for advisors exiting the business. In simple math, a shortage of successors has a few potential implications:

Fewer buyers + lots of sellers = lower valuations?

Even more entrance of P.E. in the buyer pool

What else? The table is wide open!

No one has a crystal ball, but here are the top trends that I see emerging to answer this question.

Trend 1: Solo Advisors Have Narrower Buyer Pool

With the continued increase of capital coming from outside the industry, P.E. is not looking to run advisor offices. They’re looking to own well-built ones. For advisors who are flying solo with small admin teams, the buyers with the deepest pockets are likely less interested. I think we’ll see more acquisitions of solo shops by small-to-mid RIAs who are looking for low-complexity growth opportunities.

Ironically, a number of those RIAs may also be making a humble play for an eventual P.E. deal. Keep an eye on these firm owners in their 40’s and early 50’s. They’ve got enough runway to build something relatively quickly and quietly.

Trend 2: Gen 2 Advisors Need to Drive Growth

I find many of the top advisors (top 10% of the industry) have a common problem: they’ve built multi-generational advisor teams, but they are still driving the majority of all new asset growth.

What happens when those sled dogs retire? Who can step up and drive new client acquisition?

Advisors who want to maximize their valuation aren’t just building multi-gen teams. They’re also intentional about developing advisors for business growth. They can’t just be service advisors; they need to be good marketers, too.

Some are doing this with a firm-wide marketing strategy that features their rising talent. Others are encouraging (and equipping) advisors to embrace personal branding.

Whatever the solution, I think business development becomes an X-factor in higher valuations as the buying pool shrinks.

Trend 3: Mid-sized RIA’s Have Enormous Opportunity

Of the three trends we’re highlighting today, this one is one of my favorites. I’m watching it happen in real-time. Here’s how I would describe it:

Firms with great culture and client service have grown to be incredibly successful.

They have no specific need or desire to acquire other advisors.

Even so, they’re getting approached by advisors looking for an exit plan.

They’re getting financially friendly which opens them up to easy acquisitions.

I like to call these “best practice firms,” which, with a little bit of smart marketing, become beacons for other advisors who want their clients to be well cared for after they retire. I’m seeing this happen organically, and I think that trend will only continue.

Keeping an Eye on the Forecast

When we discuss the industry’s future, there are always many possibilities. It has already changed rapidly over the last 5-10 years, and there are no signs of settling down.

Here’s my primary takeaway: if you are within 10 years of a desired exit, start doing due diligence with intentionality. Like investing, the earlier you start, the more options you have. Starting early gives you options like:

Sell and stay for smooth transitions

More opportunity to develop your business for a strong sale

Be more picky about the firm and culture you sell to

More leverage over the terms regarding your team

It’s a much longer list, but the bottom line: more runway = a smoother process.

If you’re in this window and want to better understand the range of strategies to consider over the next 5-10 years, let’s connect. All conversations are fully discrete, and in my role, I serve advisors as a fiduciary-side recruiter. I help connect great advisors with firms that deserve them.